startup tips

What’s a valuation cap and why do you need it

A Valuation cap is, without a doubt, the most important term of your seed investment contract, be it a convertible note or a SAFE. But, how does it work?

Startup distractions: things to avoid when running a business in parallel with product development

As a startup founder or business owner, you need to steer clear of startup distractions and find the time to handle the really important tasks at hand.

How to write a term sheet for a convertible note

Signing a term sheet for a convertible note is a kind of a no-strings-attached agreement, between a startup and investors. But, how do you write one?

Startups: in search of the right problem to solve

Startup founders usually have both knowledge and experience to solve problems. But, are they any good at finding the right problem to solve?

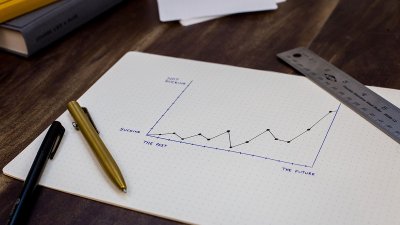

Get your startup from product to business development

Product development is disappointingly isolated from other business operations? Shift your focus and get your startup from product to business development.

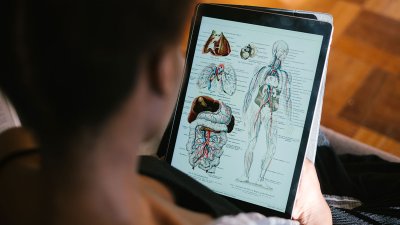

The three essential elements in a successful startup

As with everything in life, there’s no secret recipe in developing a successful startup. But there are some tricks of the trade to help you get there.

Why outsourcing is not a wise choice for startups — pt.2

We’ve learnt why businesses would elect to go down the path of outsourcing certain business aspects. Now, lets find out how outsourcing affects startups.

Why outsourcing is not a wise choice for startups — pt.1

To outsource or not outsource? For us, there is no dilemma at all. A startup reacts entirely differently to outsourcing than a standard business would.

From project to product mindset: startups’ key mentality shift

Software developers into entrepreneurs? Sure! But there needs to be a shift in mentality throughout the team. A shift from project to product mindset.